Individual Retirement Accounts (IRAs) and 401(k) plans have always been considered as long-term savings accounts that provide tax benefits if you follow certain IRS rules. While many financial institutions will not enable you to invest in real estate with your IRA owing to higher paperwork requirements, the IRS does not prohibit you from doing so. To access money for investment, you can make transfers or take out loans against your 401(k). With careful design, each style of retirement plan can have minimal or no tax consequences. Here are some steps to help guide you:

Inquire with the administrator of your retirement plan Because many IRA custodians do not allow real estate investments, you must first discover whether your IRA is permitted to make real estate acquisitions. While your 401(k) cannot legally invest in real estate, your administrator may have recommendations for how you might relocate your assets to gain access to the real estate market.

Look into loan regulations While you cannot borrow against an IRA, you may normally borrow half of the value of your 401(k), up to $50,000. However, if you buy real estate with money that isn’t from your 401(k), you won’t get any tax breaks. To keep taxes low, you must limit your income and capital gains to the best of your abilities, but this will most certainly contradict the goal of your investment.

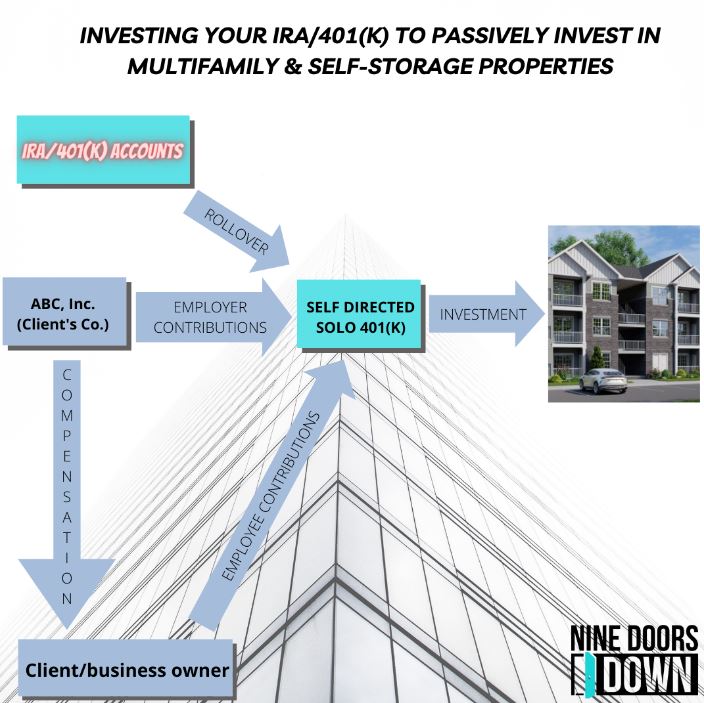

Open a self-directed IRA or self-directed 401(k), depending on your situation If your IRA custodian does not permit real estate investments, you can open your own self-directed IRA/401(k) at a firm that does permit such investments.

Roll over your 401(k) Although you cannot invest directly in real estate in a 401(k) account, you can rollover your 401(k) into an IRA tax-free and then use the proceeds to invest in real estate.

Hire a real estate management company If you purchase real estate through an IRA, you cannot actively manage the property. In order to enjoy the tax advantages of your IRA, you must hire an outside person or agency to perform maintenance on the property, collect rent and otherwise actively manage the investment.

Monitor cash flow If you purchase real estate through a retirement account, all funds used to purchase the property must come from the account, and any proceeds such as rental income or sales proceeds must be returned to the IRA. If you follow these restrictions, your real estate investment will have little or no tax ramifications, just like all other investments within your IRA.

If you’d like to learn more, please schedule a meeting with us by clicking on the button below or by visiting our website at www.ninedoorsdown.com.